Tito Mboweni | We cannot spend our way out of low growth

News24

15 Jul 2020, 01:40 GMT+10

South Africa faces a number of structural constraints to growth that were identified in the National Development Plan. In response, detailed structural reforms were articulated in government's document entitled . These reforms are structural in the sense that they do not respond to cyclical changes in economic activity (like a downturn in global demand) or sudden demand or supply shocks (such as the Covid-19 pandemic).

Instead these structural reforms are meant to strengthen a country's resilience to cyclical changes by addressing the underlying structural elements that contribute to low growth. The release of telecommunications spectrum is an example of a structural reform that can enhance the ability of businesses to deploy new technologies, lower the cost of data for households and act as a mechanism to allow new participants to enter the industry.

Since 2017, despite strong spending growth, investment has collapsed, dragging down economic growth. Investment growth has been negative in 12 of the last 17 quarters. There was a 20.5% decline in investment in the first quarter of 2020, before the onset of Covid-19.

One explanation for the recession and low levels of investment that preceded Covid-19, which is consistent with a careful review of the economics literature, is that South Africa's fiscal multipliers are in fact quite small.

A fiscal multiplier measures the impact of fiscal policy decisions, that is government's spending and tax decisions, on output (or private spending and investment). This empirical finding is unsurprising because the international literature shows that multipliers in emerging markets are smaller than in advanced economies and can be negative, particularly in the longer term and when public debt is high.

High-debt countries have lower multipliers, because fiscal consolidation is likely to have positive credibility and confidence impacts on private demand and the interest rate risk premium. Studies that find higher fiscal multipliers do so because they tend to ignore debt dynamics. As we demonstrate in a paper on fiscal multipliers published through our research partnership, , in countries with high debt such as ours, unsustainable spending increases can actually have a contractionary impact on growth because higher debt service costs crowd out important economic and social expenditure.

In other words, recent spending growth has raised aggregate economic risks, and, with it, the costs of borrowing in the economy as a whole. South Africa's risk premium - the additional return that investors demand to compensate for higher risk - increased from 3.2% at the end of 2019 to 5.3% by 30 June 2020.

A higher risk premium means that South Africa has to pay more to borrow money because our lenders are concerned that we cannot repay our debt. This is dangerous for us because we rely on others to fund the structural gap between our revenue and expenditure that has persisted since 2009.

Higher borrowing costs lower investment as businesses expect tax increases in the future and constrains the ability of state-owned companies and the government to invest in public infrastructure. This results in slower economic growth and less employment.

The belief that we can spend our way out of low growth is inconsistent with the best available empirical evidence and ignores South Africa's recent poor performance in using government spending as a tool to unlock much-needed economic growth. Gambling with our future on risky economic strategies that have failed elsewhere is something we are not prepared to do.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Boston Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Boston Star.

More InformationBusiness

SectionWall Street has relapse Wednesday, after Tuesday's heady gains

NEW YORK, New York - U.S. stocks were weaker Wednesday, following Tuesday's heady gains when the Dow Jones jumped 741 points. Bond...

China’s GAC launches in Brazil as EV demand accelerates

SAO PAULO, Brazil: Amid a surge in electric vehicle (EV) adoption and growing competition in Brazil, Chinese automaker GAC has officially...

McDonald’s to shut down CosMc’s drink spinoff after short run

CHICAGO, Illinois: McDonald's is closing its experimental beverage spinoff, CosMc's, less than two years after launching the standalone...

China’s Lenovo profit plunges 64%, misses estimates sharply

BEIJING, China: China's Lenovo reported a steep 64 percent drop in fourth-quarter profit, falling significantly short of analyst expectations...

Economic data gives welcome relief to Wall Street

NEW YORK, New York - Strong economic data jump-started U.S. stocks and the dollar Tuesday, a welcome reprieve after weeks of pressure...

PepsiCo cleared in FTC case over Walmart discounts

NEW YORK CITY, New York: This week, the U.S. Federal Trade Commission (FTC) dropped its lawsuit against PepsiCo, which had accused...

Massachusetts

SectionForeign students at Harvard bear the brunt of White House ban

BOSTON, Massachusetts: U.S. President Donald Trump's administration has taken away Harvard University's right to enroll international...

Xinhua Headlines: Shocked, angry and worried -- int'l students react to Harvard ban

* Over the past weekend, the federal government's policy banning the oldest U.S. university from enrolling international students sparked...

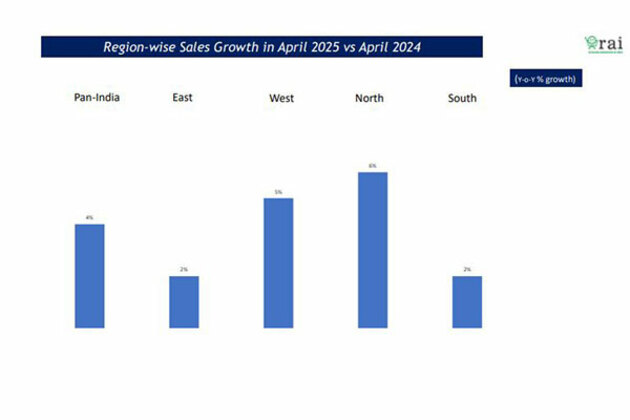

April saw a 4% rise in retail sales in India: Survey

New Delhi [India], May 27 (ANI): A 4 per cent yearly increase in retail sales was reported in April compared to the same month of 2024,...

Daily World Briefing, May 24

Trump announces planned partnership of U.S. Steel, Nippon Steel U.S. President Donald Trump announced on Friday that there will be...

Martin Elling, Ex-McKinsey partner sentenced to prison for obstructing justice by a US court

New Delhi [India], May 23 (ANI): Martin Elling, former partner at McKinsey & Co., received a six-month prison sentence for obstructing...

Trump bans Harvard from accepting foreign students

The Ivy League institution has been given 72 hours to comply with the US administrations demands The Trump administration has revoked...