Abrdn's U.S. Closed-End Funds Announce Special Shareholder Meetings Relating to Proposed Acquisition of Assets of Four Delaware Management Company-Advised Closed-End Funds

ACCESS Newswire

12 Aug 2022, 01:55 GMT+10

PHILADELPHIA, PA / ACCESSWIRE / August 11, 2022 / The Board of Trustees of each of the Acquiring Funds, listed below, announces the proposed reorganization of several closed-end investment companies advised by one or more affiliates of Delaware Management Company into the respective Acquiring Funds ('Reorganizations'). The proposed Reorganizations are subject to the receipt of necessary shareholder approvals by each Fund:

The combination of the merging funds will help ensure the viability of the Funds, increasing scale, liquidity and marketability changes that may lead to a tighter discount or a premium to NAV over time. Following the Reorganizations, shareholders of each Acquiring Fund will experience an increase in the assets under management and a reduction in their Fund's total expense ratios. There are no proposed changes to the current objectives or policies of the Acquiring Funds as a result of these Reorganizations, including the Funds' monthly distribution policies. Individually, each Board believes that the Reorganizations are in the best interest of their Fund's shareholders recognizing the strategic objective of creating scale for the benefit of shareholders.

Shareholders of the Acquiring Funds will be asked to approve the issuance of shares at a special virtual shareholder meeting tentatively scheduled for November 9, 2022 (the 'Meeting'). Each Acquiring Fund Board has fixed the close of business on August 11, 2022 as the record date for the determination of shareholders entitled to vote at the Meeting and at any adjournment of the Meeting. Each approval of the special resolution of the shareholders authorizing the issuance of new shares will require the affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote.

It is currently expected that each Reorganization will be completed in the first quarter of 2023 subject to (i) approval of the Reorganization by the respective Acquired Fund shareholders, (ii) approval by the respective Acquiring Fund shareholders of the issuance of shares of the Acquiring Funds, and (iii) the satisfaction of customary closing conditions. No Reorganization is contingent upon any other Reorganization.

The Board of Trustees to each Acquired Fund and the Board of Trustees of each Acquiring Fund believe that the proposed Reorganization is in the best interests of the shareholders of that Fund.

Additional information regarding the Reorganizations will be presented in a prospectus/proxy statement sent to each Acquired Fund's shareholders and a proxy statement sent to each Acquiring Fund's shareholders (together, the 'Proxy Statements'). Each Acquiring Fund's shareholders will be asked to approve the issuance of additional shares in connection with the respective Reorganization. Shareholders of each Acquired Fund will be asked to vote on the Reorganization of their fund into the respective Acquiring Fund at a special meeting currently targeted for November 2022.

The Proxy Statements have yet to be filed with the US Securities and Exchange Commission (the 'SEC'). After the Proxy Statements are filed with the SEC, each may be amended or withdrawn. The prospectus/proxy statement will not be distributed to shareholders of the Acquired Fund unless and until a Registration Statement comprising of the prospectus/proxy statement is declared effective by the SEC.

Important Information

In the United States, abrdn is the marketing name for the following affiliated, registered investment advisers: abrdn Inc., Aberdeen Asset Managers Ltd., abrdn Australia Limited, abrdn Asia Limited, Aberdeen Capital Management, LLC, abrdn ETFs Advisors LLC and Aberdeen Standard Alternative Funds Limited.

The information in this press release is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

In connection with the proposed combination, the Acquired Funds and their corresponding Acquiring Funds plan to file with the Securities and Exchange Commission a combined joint prospectus/proxy statement and the Acquiring Funds plan to file proxy statements. When the prospectus/proxy statements or proxy statements, as the case may be, become available, shareholders are advised to read it because it will contain important information about the proposed transaction and related matters. The prospectus/proxy statements and proxy statements, when available, will be available for free at the Commission's website www.sec.gov.

Closed-end funds are traded on the secondary market through one of the stock exchanges. The Funds' investment return and principal value will fluctuate so that an investor's shares may be worth more or less than the original cost. Shares of closed-end funds may trade above (a premium) or below (a discount) the net asset value (NAV) of the fund's portfolio. There is no assurance that the Fund will achieve its investment objective. Past performance does not guarantee future results.

For More Information Contact:

abrdn U.S. Closed-End Funds

Investor Relations

1-800-522-5465

[email protected]

If you If you wish to receive this information electronically, please contact [email protected]

https://www.abrdn.com/en-us/cefinvestorcenter/fund-centre/closed-end-funds

SOURCE: abrdn U.S. Closed-End Funds

View source version on accesswire.com:

https://www.accesswire.com/711816/Abrdns-US-Closed-End-Funds-Announce-Special-Shareholder-Meetings-Relating-to-Proposed-Acquisition-of-Assets-of-Four-Delaware-Management-Company-Advised-Closed-End-Funds

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Boston Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Boston Star.

More InformationBusiness

SectionBeijing hits back at EU with medical device import curbs

HONG KONG: China has fired back at the European Union in an escalating trade dispute by imposing new restrictions on medical device...

Wall Street reels after Trump invokes new tariffs

NEW YORK, New York - Monday's trading session saw mixed performances across U.S. and global markets, with several major indices posting...

Trump admin allows GE to restart engine sales to China’s COMAC

WASHINGTON, D.C.: The U.S. government has granted GE Aerospace permission to resume jet engine shipments to China's COMAC, a person...

Saudi Aramco plans asset sales to raise billions, say sources

DUBAI, U.A.E.: Saudi Aramco is exploring asset sales as part of a broader push to unlock capital, with gas-fired power plants among...

Russia among 4 systemic risk countries for Italian banks

MILAN, Italy: Italian regulators have flagged four non-EU countries—including Russia—as carrying systemic financial risk for domestic...

US debt limit raised, but spending bill fuels fiscal concerns

NEW YORK CITY, New York: With just weeks to spare before a potential government default, U.S. lawmakers passed a sweeping tax and spending...

Massachusetts

SectionEngine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

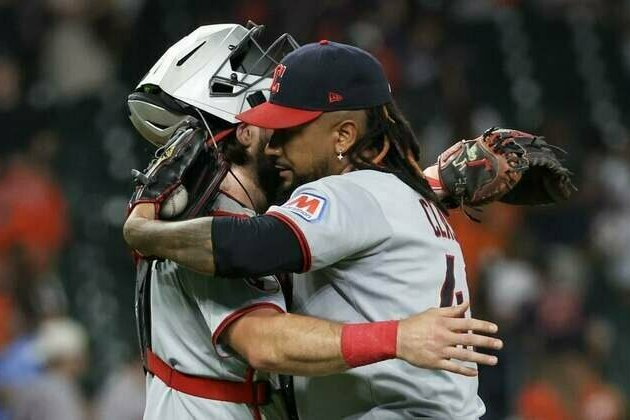

MLB roundup: Guardians top Astros to halt 10-game skid

(Photo credit: Thomas Shea-Imagn Images) Brayan Rocchio lined a go-ahead, two-run double into the left field corner with two outs...

Roman Anthony's hot bat leads Red Sox in rout of Rockies

(Photo credit: Paul Rutherford-Imagn Images) Roman Anthony hit his first career home run at Fenway Park en route to his sixth multi-hit...

Two-time Stanley Cup winner Tyler Johnson announces retirement

(Photo credit: Kim Klement-Imagn Images) Tyler Johnson, who played 13 seasons in the NHL and won back-to-back Stanley Cups with the...

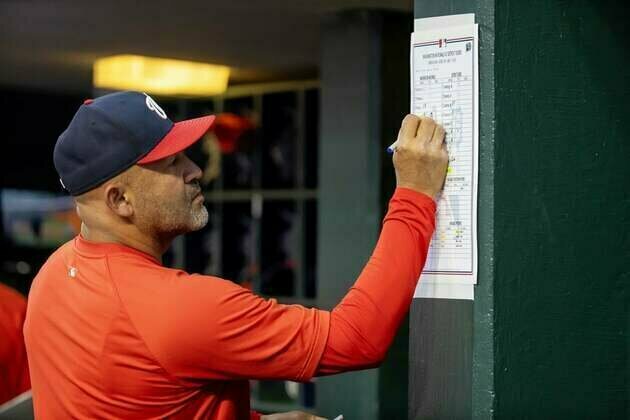

After big shake-up, Miguel Cairo leads Nationals against Cardinals

(Photo credit: David Reginek-Imagn Images) The struggling Washington Nationals flew into St. Louis with new leadership in both the...

Hawks officially bring in F/C Kristaps Porzingis, waive F David Roddy

(Photo credit: Matt Marton-Imagn Images) The Atlanta Hawks officially welcomed Kristaps Porzingis on Monday while waiving forward...