Wall Street trades sideway as Mideast tensions subside

Lola Evans

26 Jun 2025, 01:43 GMT+10

- The tech-heavy Nasdaq Composite climbed 0.31 percent to 19,973.55

- The Dow Jones Industrial Average fell 106.59 points, or 0.25 percent, to 42,982.43.

- The Standard and Poor's 500 closed flat at 6,092.16 in thin trading.

NEW YORK, New York, - U.S. stocks were split, but little moved Wednesday after a positive start to the week heralded by a two-day rally. On Wednesday it was business as usual as buyers and sellers appeared equally matched on both sides of the ledger.

"There is a battle in the markets between some of the secular tailwinds, which should positively impact asset prices long term (AI, robotics, crypto, and many other technological innovations), and the cyclical headwinds of possible policy missteps," Leah Bennett, chief investment strategist at Concurrent Asset Management told CNBC Wednesday. "The former seems to be winning today."

The Nasdaq Composite extended gains while the Dow and S&P 500 dipped slightly.

Key U.S. Indexes Show Divergence

The Standard and Poor's 500 closed flat at 6,092.16 in thin trading.

The Dow Jones Industrial Average fell 106.59 points, or 0.25 percent, to 42,982.43, weighed down by losses in industrial and financial stocks.

In contrast, the tech-heavy Nasdaq Composite climbed 0.31 percent to 19,973.55, buoyed by strength in megacap tech names.

Trading volumes, excpt for the S&P 500, were robust, with the Nasdaq seeing 7.21 billion shares exchanged.

Market Drivers

Analysts noted that investors remained cautious ahead of key economic data, including Friday's U.S. jobs report, while still digesting the latest corporate earnings. The Nasdaq's resilience suggested continued appetite for growth stocks despite lingering interest rate uncertainty.

Global Forex Markets Continue to see Weakness in US. Dollar on Wednesday

The foreign exchange market witnessed further declines in the U.S. dollar in major currency pairs during Wednesday's trading session, as investors assessed the latest geopolitical developments, economic data and central bank expectations.

The EUR/USD pair rose to 1.1660, marking an increase of 0.45 percent, as the euro strengthened against the U.S. dollar amid shifting market sentiment. Meanwhile, the USD/JPY edged higher to 145.16, up 0.19 percent, as the yen remained under pressure against the greenback due to interest rate differentials.

The USD/CAD saw minimal movement, inching up just 0.01 percent to 1.3724, reflecting steady demand for the US dollar against its Canadian counterpart.

The GBP/USD climbed 0.41 percent to 1.3668, as the British pound continued to meet demand. The pound now stands at a more than 3-year high, having advanced nearly 9 percent this year..

The USD/CHF dipped 0.11 percent to 0.8042, signaling slight weakness in the U.S. dollar against the Swiss franc. The AUD/USD advanced 0.36 percent to 0.6512, supported by improved risk appetite, while the NZD/USD led gains with a 0.58 percent rise to 0.6039, as the New Zealand dollar outperformed.

Global Markets Close Mixed on Wednesday; Asia Outperforms While Canada, UK, Europe Decline

Global stock markets delivered a mixed performance in Wednesday's session, with Asian indices leading gains while UK and European benchmarks faced broad declines.

Canada's TSX Slips on Commodity Weakness

North of the U.S. border, the S&P/TSX Composite dropped 0.57 percent to 26,566.32, marking one of the day's weaker performances among major global benchmarks. The decline came as energy and materials stocks lagged amid softer commodity prices.

UK and European Markets End Lower

European equities struggled as investors weighed economic concerns and corporate earnings. The UK's FTSE 100 fell 0.46 percent to 8,718.75, while Germany's DAX dropped 0.61 percent to 23,498.33. France's CAC 40 declined 0.76 percent to 7,558.16, and the EURO STOXX 50 slid 0.85 percent to 5,252.01. Belgium's BEL 20 mirrored the trend, shedding 0.76 percent to 4,457.12.

Asian Markets Rally

In contrast, Asian indices posted strong gains. Hong Kong's Hang Seng Index surged 1.23 percent to 24,474.67, while Singapore's STI Index rose 0.56 percent to 3,925.98. India's S&P BSE SENSEX climbed 0.85 percent to 82,755.51, and Taiwan's TWSE Index jumped 1.09 percent to 22,430.61. Japan's Nikkei 225 edged up 0.39 percent to 38,942.07, and China's Shanghai Composite gained 1.04 percent to 3,455.97.

South Korea's KOSPI rose 0.15 percent to 3,108.25, and Malaysia's KLSE gained 0.36 percent to 1,519.79.

Mixed Moves in Pacific Regions

Australia's S&P/ASX 200 inched up 0.04 percent to 8,559.20, while the broader All Ordinaries added 0.06 percent to 8,779.90. New Zealand's NZX 50 dipped slightly by 0.05 percent to 12,460.96.

Standout Performers in Mideast Markets

Israel's TA-125 led gains, soaring 1.71 percent to 2,973.48, while Egypt's EGX 30 surged 1.24 percent to 33,002.80. South Africa's Top 40, however, bucked the trend, falling 0.80 percent to 5,306.17.

Related story:

Tuesday 24 June 2025 | Dow Jones jumps 507 points as Mideast truce takes hold | Big News Network

Monday 23 June 2025 | Wall Street forges ahead despite despite weekend attacks on Iran | Big News Network

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Boston Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Boston Star.

More InformationBusiness

SectionWall Street trades sideway as Mideast tensions subside

NEW YORK, New York, - U.S. stocks were split, but little moved Wednesday after a positive start to the week heralded by a two-day rally....

Tesla robotaxi trials begin in Austin

NEW YORK CITY, New York: Elon Musk is taking a big step toward making his long-promised robotaxi dream a reality. Over the weekend,...

Toyota hikes US auto prices, says move is not tariff-driven

PLANO, Texas: Toyota Motor will raise prices across a range of vehicles in the United States starting next month, the Japanese automaker...

Tariffs, inflation raise stagflation risk as Fed eyes next move

WASHINGTON, D.C.: U.S. business activity showed signs of softening in June while inflationary pressures continued to build, driven...

U.S. stocks extend rally as Israel and Iran make peace

NEW YORK, New York - U.S. stock markest closed sharply higher on Tuesday as a truce entered into between Irsael and Iran after 12 days...

Meta unveils Oakley AI glasses as next step in wearable tech push

MENLO PARK, California: Meta is taking another swing at smart eyewear—this time with a sporty edge. The company announced a new partnership...

Massachusetts

SectionNext-gen weight-loss drugs aim to cut fat, spare muscle

WASHINGTON, D.C.: As the global weight-loss market explodes, drugmakers are now racing to solve a less visible problem: protecting...

India witnesses surge in millionaires, outpacing Asia Pacific; eyes 55% rise by 2029

Mumbai (Maharashtra) [India], June 25 (ANI): The number of individuals in the top wealth brackets--those with more than a million dollars...

Ezra Milller considers returning to Hollywood after time away from public eye

Washington DC [US], June 23 (ANI): Actor Ezra Miller may be planning a return to Hollywood after staying out of the public eye for...

Latest global rankings show shift in global research landscape

Beyond the Nature Index, numerous global rankings have also highlighted Asia's growing influence, particularly China's significant...

Official 2025 Cowboys training camp calendar, dates revealed

FRISCO, TexasGo ahead and grab a calendar and your favorite blue pen, folks, because it's officially time to mark your dates for the...

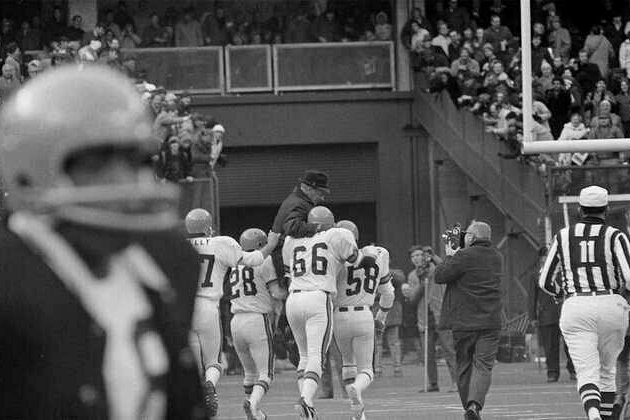

Bengals Season In Review: 1970

Michael Hull In the weeks leading up to training camp, we will look back at a few of the most pivotal seasons in Bengals history....